- Minnesota Charitable Gambling Laws

- Minnesota Charitable Gambling Made Easy

- Mn Charitable Gambling Rules For Real

Due to potential disruptions to the AGO's operations in light of the COVID-19 outbreak, the AGO has automatically extended for four months the deadline for soliciting charitable organizations to file FY19 annual reports that are currently due between April 15, 2020 and July 15, 2020, under Minn. Stat. § 309.53.

- New due dates for affected organizations are listed below:

| Accounting Year-End | Annual Report Due Date | Automatic Extended Due Date |

| September 30, 2019 | April 15, 2020 | August 17, 2020 |

| October 31, 2019 | May 15, 2020 | September 15, 2020 |

| November 30, 2019 | June 15, 2020 | October 15, 2020 |

| December 31, 2019 | July 15, 2020 | November 16, 2020 |

Charitable Gambling in Minnesota Charitable gambling has been legal in Minnesota since 1945. This information brief describes the legislative history, rules and regulations, and the outlook for charitable gambling. This information brief is only a summary of the law and rules governing charitable gambling. This information brief has four parts. 'Minnesota has unusual laws related to charitable gambling,' Knoblach said. 'The money that is left over after all expenses and taxes are paid goes 100 percent to charitable activities, yet we tax charitable gambling at a higher rate than any other organization of which I am aware of.'. Charitable Gambling in Minnesota Charitable gambling has been legal in Minnesota since 1945. This information brief describes the legislative history, rules and regulations, and the outlook for charitable gambling. This information brief is only a summary of the law and rules governing charitable gambling.

- You do NOT need to request an extension if your reporting deadline falls into this time period. It is automatically extended.

- You are encouraged to file toward the end of your new extended deadline to increase the AGO's ability to process your filings in a timely manner.

- You are encouraged to file electronically to increase the AGO's ability to process your filings in a timely manner.

- No late fees will be assessed if you file by your new extended due date.

- All other deadlines and obligations remain the same.

- These changes do not apply to charitable trusts filings under Minn. Stat. s 501B.

Most charitable organizations that solicit contributions or have significant charitable assets must register and, thereafter, file an annual report and certain other documents with the Attorney General's Office. The registry of charities consists of two types of organizations—soliciting charities and charitable trusts. The Minnesota Charitable Solicitation Act, Minn. Stat. ch. 309, governs the activities of soliciting charities. The Minnesota Supervision of Charitable Trusts and Trustees Act, Minn. Stat. ch. 501B, governs the activities of charitable trusts. While the below information provides a summary of the registration and reporting requirements for soliciting charities and charitable trusts, these Acts control and should be carefully reviewed to ensure that soliciting charities and charitable trusts are complying with their terms. You can also consult A Guide to Minnesota's Charities Laws for more information.

Soliciting Charity Registration and Reporting

Registration. Unless exempt, soliciting charities must register if they meet any of the following conditions: (1) The charity receives or plans to receive more than $25,000 in total contributions during its accounting year, or (2) the charity's functions and activities, including fundraising, are not performed wholly by volunteers, or (3) the charity utilizes a professional fundraiser. See Minn. Stat. §§ 309.515, .52. Soliciting charities must pay a $25 fee, complete a registration form (see below), and file certain documents with the Attorney General's Office when they register. A charity must file a copy of any contract it has entered into with a professional fundraiser when registering. If a charity enters into a contract with a professional fundraiser after registering, it must file a copy of the contract within seven days. Minn. Stat. § 309.52.

Annual Reporting. Every soliciting charity must annually submit a report on its operations and activities. Charities that file IRS Form 990 should attach it to their annual report. Charities that file a shortened version of Form 990 (e.g., Form 990-EZ, 990-PF, or 990-N) must complete the financial statement portion of the annual report. A charity's Form 990 or financial statement (whichever is applicable) must be complete, accurate, and GAAP compliant. The report must be executed pursuant to a resolution of the board of directors and must be signed by two officers. The deadline for filing an annual report is July 15 of each year if the charity's books are kept on a calendar year basis, or the 15th day of the seventh month following the close of the charity's fiscal year if its books are kept on a fiscal year basis. The charity must pay a $25 fee with filing its annual report, and a $50 late fee if the complete report is not filed by the deadline. Minn. Stat. § 309.53.

Forms for Registration and Reporting. To register, a soliciting charity must submit an Initial Registration form, including all of the documents that must be attached to the form. Every year after registering, a charity must submit an Annual Report, including all of the documents that must be attached to the report. These documents can be downloaded using the below links:

The available sports that Ladbrokes allow customers to bet live on, include: Football, Tennis, Basketball, Volleyball, Cricket and E-Sports (Virtual Sports). Players who claim the Ladbrokes promo code can use the bonus funds on some of the live betting markets. As well as this, Ladbrokes also allow their customers to live stream events. Max 1 prize per customer/day. Prizes Include: Cash Min £0.50, Max £100. £1 Bonus 1x wag. Free Spins Min 1, Max 5. FS value Min £0.01, Max £2. Selected games only. Prize must be accepted within 48hrs. Valid for 7 days. 96% of Instant Spins customers who took part during November 2020 won a prize. Player restrictions & T&Cs apply. Ladbrokes Promo Codes 2019 – Enjoy Free Cash The Meaning and Advantages of Casino Promo Codes. If you are among those who like to enjoy cheats, coupons and vouchers from firms, then understanding the meaning of the Ladbrokes promo code will be easy for you. Ladbrokes casino promo code existing customers 2019.

Charitable Organization - Initial Registration*First time registering? Please use this form

Charitable Organization - Annual Report

The Attorney General's Office also accepts the Unified Registration Statement ('URS'), which some charities that must register and report in multiple jurisdictions prefer to file. If a charity chooses to submit a URS, it must also submit the Minnesota supplement to the form. The Minnesota supplements to the URS can be downloaded using the below links:

Minnesota Supplement to URS - Initial Registration*First time registering? Please use this form

Minnesota Supplement to URS - Annual Reporting

Exemptions from Registration and Reporting. Some soliciting charities are exempt from registration, including certain kinds of educational and religious organizations. Charities should review Minnesota Statutes section 309.515 for a full list of exemptions from registration. If a charity believes that it is not required to register with the Attorney General's Office, it should notify the Office and submit an exemption form, which can be downloaded using the below link:

Charitable Trust Registration and Reporting

Registration and Reporting. A charitable organization must register with the Attorney General's Office as a charitable trust if it has assets of more than $25,000 at any point in time during the year and is not required to register as a soliciting charity. SeeMinn. Stat. § 501B.36. To register, the organization must submit an initial registration form, the organization's articles of incorporation or the document creating the trust, and IRS Form 990 or a financial statement. Every year after registering, a charitable trust must file an annual report, and attach IRS Form 990 or a financial statement. The annual report must be filed by the 15th day of the fifth month following the close of the organization's taxable year. A charitable trust must pay a $25 fee when registering and with each annual report. These registration and reporting documents can be downloaded using the below links:

Charitable Trust – Initial Registration*First time registering? Please use this form

Charitable Trust – Annual Report

Exemptions from Registration and Reporting. Not all charities are required to register with the Attorney General's Office as charitable trusts. An organization that has registered as a soliciting charity does not also need to register as a charitable trust. Certain religious organizations and trusts administered by a government agency, for example, are also exempt from registration as a charitable trust. Organizations that are not required to register as a soliciting charity should review Minn. Stat. § 501B.36 for a full list of charitable trust registration exemptions. If an organization believes that it is not required to register as a charitable trust, it should notify the Attorney General's Office and submit an exemption form, which can be downloaded using the below link:

How To Register and Report

Electronic Filing of Documents. Charities may register and make all required filings by email. Organizations may submit required materials to the Attorney General's Office at charity.registration@ag.state.mn.us. All materials submitted via email must be in PDF format and the subject line of the email must contain the organization's legal name. Emails not following these requirements may not be properly processed, which could result in noncompliant registration and reporting.

Electronic Payment of Fees. Charities may pay all required fees, including any late fees, electronically using the Attorney General's Office's Electronic Payment of Fees webpage. This electronic payment system has a self-directed, step-by-step process allowing charities to pay fees via credit or debit card through a dedicated webpage operated by U.S. Bank. Please note there is a nonrefundable processing fee charged by U.S. Bank for organizations that choose to pay required fees electronically.

Submissions/Payments by Mail. If charities prefer, they may submit required materials by mail and pay required fees by check. Checks should be made payable to the 'State of Minnesota.' Required documents and payments should be mailed to the following address:

Minnesota Attorney General's Office

Charities Division

445 Minnesota Street, Suite 1200

St. Paul, MN 55101

Charities may contact the Minnesota Attorney General's Office at (651) 757-1496 or (800) 657-3787 with any questions about registration and reporting.

Additional Resources

Anyone may search for charitable organizations and charitable trusts that are currently registered in Minnesota by using the Attorney General's Office's Search for Charities tool. Be aware, however, that just because a charity is registered does not necessarily mean it is worthy of your generosity. Before contributing to any charity, donors should do enough research to assure themselves that the charity will use their contribution to fulfill its charitable mission.

Use the links below to download forms and learn more about the Minnesota Charitable Solicitation Act and the Supervision of Charitable Trusts and Trustees Act:

Charitable Organization - Initial Registration

Charitable Organization - Annual Report

Minnesota Supplement to Unified Registrations - Initial Registration

Minnesota Supplement to Unified Registrations - Annual Reporting

Charitable Organization – Exemption Form

Charitable Trust – Initial Registration Form

Charitable Trust – Annual Report

Charitable Trust – Exemption Form

Minnesota Charitable Solicitation Act

Minnesota Supervision of Charitable Trusts and Trustees Act

More resources are available from the following organizations:

Internal Revenue Service

Minnesota Secretary of State's Office

Minnesota Charities Review Council

Propel Nonprofits

Guidestar

Minnesota Council of Nonprofits

Minnesota Council on Foundations

Links to Each Chapter of the Lawful Gambling Manual Entire 2020 Lawful Gambling Manual (275 pages)

This chapter outlines requirements that an organization must meet to obtain an organization license.

This chapter outlines the requirements for the position of gambling manager.

To be able to conduct gambling at a premises, whether leased or owned, an organization must meet the specific requirements outlined in this chapter.

This chapter contains information on the conduct and reporting of electronic pull-tabs and electronic linked bingo.

This chapter contains information on paper pull-tab conduct, paper pull-tab dispensing devices, point-of-sale systems, reporting, and common problems.

This chapter contains information on bingo conduct, bingo games, bar bingo, reporting and frequently asked questions regarding bingo.

This chapter contains information on raffle conduct, inventory, and records.

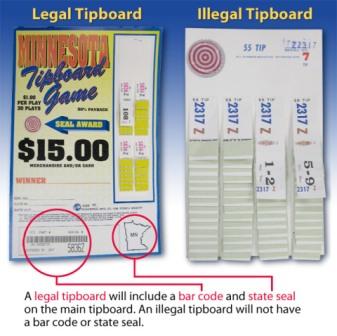

This chapter contains information on the conduct of tipboards, reports, and common questions.

This chapter contains information on the conduct of paddlewheels, records, and reports.

This chapter, one of the most important in this manual, outlines and emphasizes the importance of good internal controls as they apply to the gambling operations for which an organization's chief executive officer, gambling manager, and members are responsible.

This chapter contains information and instructions on the required inventory systems for paper pull-tab, tipboard, and paddlewheel games. The four required inventory systems are perpetual, physical, site, and merchandise prize. Electronic games, bingo, and raffle inventory instructions are located in the Electronic Games, Bingo, and Raffle chapters.

Minnesota Charitable Gambling Laws

This chapter covers the expenditures known as allowable expenses. These expenses must be directly related to lawful gambling and paid from the gambling account.

This chapter covers the expenditures that an organization makes from its gambling account for donations and certain taxes. Some LPE are also called 'charitable contributions'.

This chapter covers the monthly reporting requirements for filing LG100A, LG100C, and LG100F with the Gambling Control Board.

Annual Reporting. Every soliciting charity must annually submit a report on its operations and activities. Charities that file IRS Form 990 should attach it to their annual report. Charities that file a shortened version of Form 990 (e.g., Form 990-EZ, 990-PF, or 990-N) must complete the financial statement portion of the annual report. A charity's Form 990 or financial statement (whichever is applicable) must be complete, accurate, and GAAP compliant. The report must be executed pursuant to a resolution of the board of directors and must be signed by two officers. The deadline for filing an annual report is July 15 of each year if the charity's books are kept on a calendar year basis, or the 15th day of the seventh month following the close of the charity's fiscal year if its books are kept on a fiscal year basis. The charity must pay a $25 fee with filing its annual report, and a $50 late fee if the complete report is not filed by the deadline. Minn. Stat. § 309.53.

Forms for Registration and Reporting. To register, a soliciting charity must submit an Initial Registration form, including all of the documents that must be attached to the form. Every year after registering, a charity must submit an Annual Report, including all of the documents that must be attached to the report. These documents can be downloaded using the below links:

The available sports that Ladbrokes allow customers to bet live on, include: Football, Tennis, Basketball, Volleyball, Cricket and E-Sports (Virtual Sports). Players who claim the Ladbrokes promo code can use the bonus funds on some of the live betting markets. As well as this, Ladbrokes also allow their customers to live stream events. Max 1 prize per customer/day. Prizes Include: Cash Min £0.50, Max £100. £1 Bonus 1x wag. Free Spins Min 1, Max 5. FS value Min £0.01, Max £2. Selected games only. Prize must be accepted within 48hrs. Valid for 7 days. 96% of Instant Spins customers who took part during November 2020 won a prize. Player restrictions & T&Cs apply. Ladbrokes Promo Codes 2019 – Enjoy Free Cash The Meaning and Advantages of Casino Promo Codes. If you are among those who like to enjoy cheats, coupons and vouchers from firms, then understanding the meaning of the Ladbrokes promo code will be easy for you. Ladbrokes casino promo code existing customers 2019.

Charitable Organization - Initial Registration*First time registering? Please use this form

Charitable Organization - Annual Report

The Attorney General's Office also accepts the Unified Registration Statement ('URS'), which some charities that must register and report in multiple jurisdictions prefer to file. If a charity chooses to submit a URS, it must also submit the Minnesota supplement to the form. The Minnesota supplements to the URS can be downloaded using the below links:

Minnesota Supplement to URS - Initial Registration*First time registering? Please use this form

Minnesota Supplement to URS - Annual Reporting

Exemptions from Registration and Reporting. Some soliciting charities are exempt from registration, including certain kinds of educational and religious organizations. Charities should review Minnesota Statutes section 309.515 for a full list of exemptions from registration. If a charity believes that it is not required to register with the Attorney General's Office, it should notify the Office and submit an exemption form, which can be downloaded using the below link:

Charitable Trust Registration and Reporting

Registration and Reporting. A charitable organization must register with the Attorney General's Office as a charitable trust if it has assets of more than $25,000 at any point in time during the year and is not required to register as a soliciting charity. SeeMinn. Stat. § 501B.36. To register, the organization must submit an initial registration form, the organization's articles of incorporation or the document creating the trust, and IRS Form 990 or a financial statement. Every year after registering, a charitable trust must file an annual report, and attach IRS Form 990 or a financial statement. The annual report must be filed by the 15th day of the fifth month following the close of the organization's taxable year. A charitable trust must pay a $25 fee when registering and with each annual report. These registration and reporting documents can be downloaded using the below links:

Charitable Trust – Initial Registration*First time registering? Please use this form

Charitable Trust – Annual Report

Exemptions from Registration and Reporting. Not all charities are required to register with the Attorney General's Office as charitable trusts. An organization that has registered as a soliciting charity does not also need to register as a charitable trust. Certain religious organizations and trusts administered by a government agency, for example, are also exempt from registration as a charitable trust. Organizations that are not required to register as a soliciting charity should review Minn. Stat. § 501B.36 for a full list of charitable trust registration exemptions. If an organization believes that it is not required to register as a charitable trust, it should notify the Attorney General's Office and submit an exemption form, which can be downloaded using the below link:

How To Register and Report

Electronic Filing of Documents. Charities may register and make all required filings by email. Organizations may submit required materials to the Attorney General's Office at charity.registration@ag.state.mn.us. All materials submitted via email must be in PDF format and the subject line of the email must contain the organization's legal name. Emails not following these requirements may not be properly processed, which could result in noncompliant registration and reporting.

Electronic Payment of Fees. Charities may pay all required fees, including any late fees, electronically using the Attorney General's Office's Electronic Payment of Fees webpage. This electronic payment system has a self-directed, step-by-step process allowing charities to pay fees via credit or debit card through a dedicated webpage operated by U.S. Bank. Please note there is a nonrefundable processing fee charged by U.S. Bank for organizations that choose to pay required fees electronically.

Submissions/Payments by Mail. If charities prefer, they may submit required materials by mail and pay required fees by check. Checks should be made payable to the 'State of Minnesota.' Required documents and payments should be mailed to the following address:

Minnesota Attorney General's Office

Charities Division

445 Minnesota Street, Suite 1200

St. Paul, MN 55101

Charities may contact the Minnesota Attorney General's Office at (651) 757-1496 or (800) 657-3787 with any questions about registration and reporting.

Additional Resources

Anyone may search for charitable organizations and charitable trusts that are currently registered in Minnesota by using the Attorney General's Office's Search for Charities tool. Be aware, however, that just because a charity is registered does not necessarily mean it is worthy of your generosity. Before contributing to any charity, donors should do enough research to assure themselves that the charity will use their contribution to fulfill its charitable mission.

Use the links below to download forms and learn more about the Minnesota Charitable Solicitation Act and the Supervision of Charitable Trusts and Trustees Act:

Charitable Organization - Initial Registration

Charitable Organization - Annual Report

Minnesota Supplement to Unified Registrations - Initial Registration

Minnesota Supplement to Unified Registrations - Annual Reporting

Charitable Organization – Exemption Form

Charitable Trust – Initial Registration Form

Charitable Trust – Annual Report

Charitable Trust – Exemption Form

Minnesota Charitable Solicitation Act

Minnesota Supervision of Charitable Trusts and Trustees Act

More resources are available from the following organizations:

Internal Revenue Service

Minnesota Secretary of State's Office

Minnesota Charities Review Council

Propel Nonprofits

Guidestar

Minnesota Council of Nonprofits

Minnesota Council on Foundations

Links to Each Chapter of the Lawful Gambling Manual Entire 2020 Lawful Gambling Manual (275 pages)

This chapter outlines requirements that an organization must meet to obtain an organization license.

This chapter outlines the requirements for the position of gambling manager.

To be able to conduct gambling at a premises, whether leased or owned, an organization must meet the specific requirements outlined in this chapter.

This chapter contains information on the conduct and reporting of electronic pull-tabs and electronic linked bingo.

This chapter contains information on paper pull-tab conduct, paper pull-tab dispensing devices, point-of-sale systems, reporting, and common problems.

This chapter contains information on bingo conduct, bingo games, bar bingo, reporting and frequently asked questions regarding bingo.

This chapter contains information on raffle conduct, inventory, and records.

This chapter contains information on the conduct of tipboards, reports, and common questions.

This chapter contains information on the conduct of paddlewheels, records, and reports.

This chapter, one of the most important in this manual, outlines and emphasizes the importance of good internal controls as they apply to the gambling operations for which an organization's chief executive officer, gambling manager, and members are responsible.

This chapter contains information and instructions on the required inventory systems for paper pull-tab, tipboard, and paddlewheel games. The four required inventory systems are perpetual, physical, site, and merchandise prize. Electronic games, bingo, and raffle inventory instructions are located in the Electronic Games, Bingo, and Raffle chapters.

Minnesota Charitable Gambling Laws

This chapter covers the expenditures known as allowable expenses. These expenses must be directly related to lawful gambling and paid from the gambling account.

This chapter covers the expenditures that an organization makes from its gambling account for donations and certain taxes. Some LPE are also called 'charitable contributions'.

This chapter covers the monthly reporting requirements for filing LG100A, LG100C, and LG100F with the Gambling Control Board.

Minnesota Charitable Gambling Made Easy

This chapter lists state and federal agencies that can assist an organization with questions on lawful gambling and provides information about the Gambling Control Board. Also included are helpful hints on locating lawful gambling statutes and rules.

Mn Charitable Gambling Rules For Real

This index references specific topics and pages on which they are located within the manual.